Smart Compliance

Smart Compliance Made Simple

Staying compliant with ever-changing tax regulations is easier than ever. Our solutions automatically apply tax rules, restrictions, and adjustments, ensuring accuracy and compliance without the manual effort.

Navigate Tax Complexity with Confidence - and Precision

Tax regulations are constantly evolving, making compliance a significant challenge for businesses and individuals. Our tax software solutions, BrassTax and Koru, take the complexity out of compliance by automating the application of intricate tax rules and restrictions, with a level of precision that sets us apart.

Multiple Tax

Treatments - Applied Simultaneously

Our system goes beyond simple tax treatment applications. We intelligently handle scenarios where a single transaction requires multiple tax treatments to be applied simultaneously. This ensures accurate calculations and compliance even in complex situations.

Automatic Application of Restrictions & Adjustments

We don’t just highlight restricted transactions; we automatically apply the necessary restrictions and integrate them into your calculations. This eliminates the need for manual computation, ensuring accurate reconciliation back to your source transactions and minimizing desrepancies.

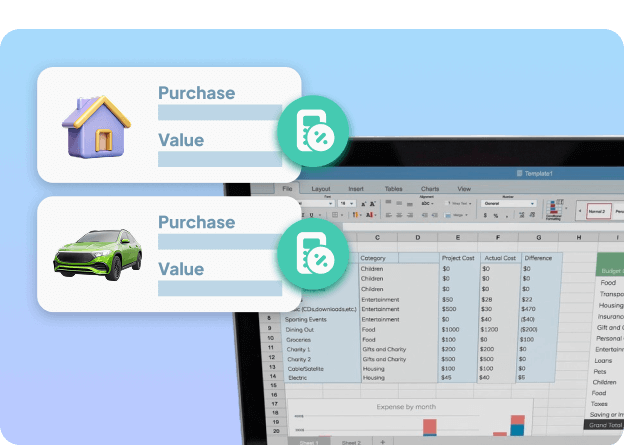

Automatic Small Value Asset Creation & Tax Adjustments

When expenses are reclassified as capital, or assets are expensed off, our system automatically creates small-value assets and applies the associated tax adjustments. This eliminates manual entries and ensures accurate asset tracking.

Individual Asset Tracking and Allowance Computation

Our software meticulously tracks each asset individually, computing allowances with precision. This ensures accurate Brought Forward values and eliminates errors associated with calculating balancing allowances and charges. This level of detail will be crucial when MITRS is implemented, as detailed Capital Allowance schedules will be required.

Up-to-Date Regulations

Our software is constantly updated to reflect the latest LHDN regulations, so you can be confident that you’re always in compliant.