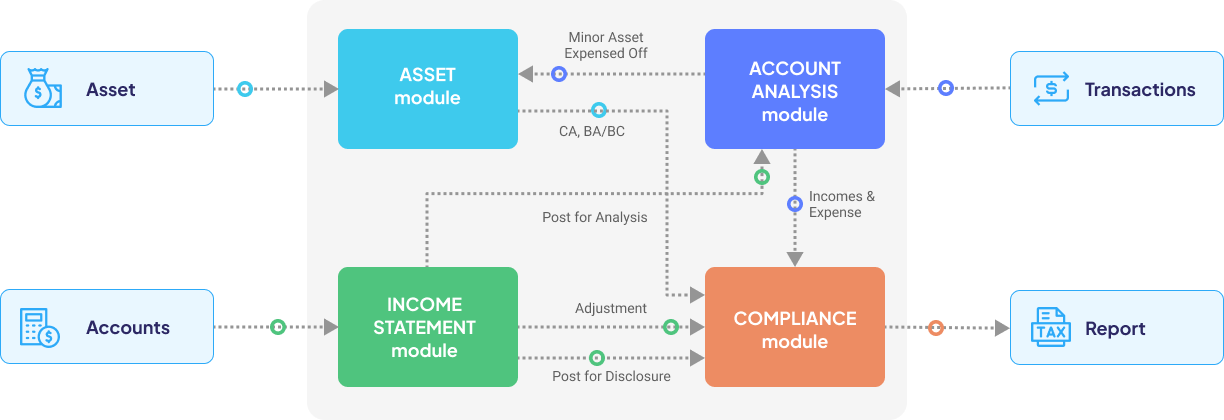

BRASSTAX® Workflow

At the heart of all our Tax Solutions is the BRASSTAX® Workflow Engine, that combines the tax rules with the Asset, Accounts and Transactions to manage the preparation of the Tax Submissions. This combined with our Efiling engine makes preparation and filing a breeze.

Compliance

| Brasstax Online | Koru | |

|---|---|---|

| Borang E (Employer) | ❌ | ✔️ |

| Borang BE (Salary Earner) | ❌ | ✔️ |

| Borang B (Sole Proprietor) | ❌ | ✔️ |

| Borang C (Corporate) | ✔️ | ✔️ |

| Borang P (Partnership) | ❌ | ✔️ |

| Non-Resident Individual (M) | ❌ | Coming Soon |

| Limited Liability Partnership (LLP) | ❌ | Coming Soon |

| Foreign exempt income computation | ❌ | Coming Soon |

| Support for 60FA | ❌ | Coming Soon |

| Live Calculations (All calculations are automatically updated as changes are made) |

✔️ | ✔️ |

| Automatically applies restrictions based on prevailing tax law (Applies to Capital Allowances, P&L Expenses, Personal Reliefs, Donations, Incentives, etc) |

✔️ | ✔️ |

| Incentives | ||

| Reinvestment Allowance (RA) | ✔️ | Coming Soon |

| Increased Exports Allowance (IEA) | ✔️ | Coming Soon |

| Accelerated Capital Allowance (ACA) | ✔️ | Coming Soon |

| Pioneer | ✔️ | Coming Soon |

| Investment Tax Allowance (ITA) | ✔️ | Coming Soon |

| Approved project under Section 127 | ✔️ | Coming Soon |

| Approved Service Projects | ✔️ | Coming Soon |

| Green Technology | ✔️ | Coming Soon |